Support Arizona Youth

ABOUT SUPPORT ARIZONA YOUTH

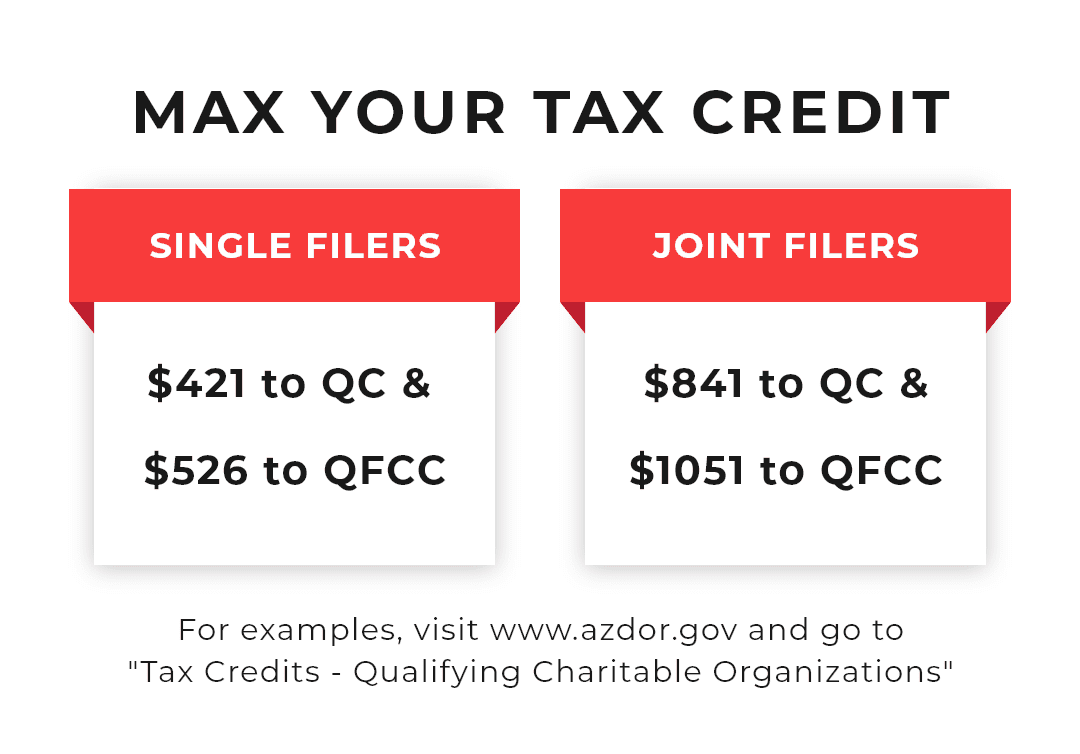

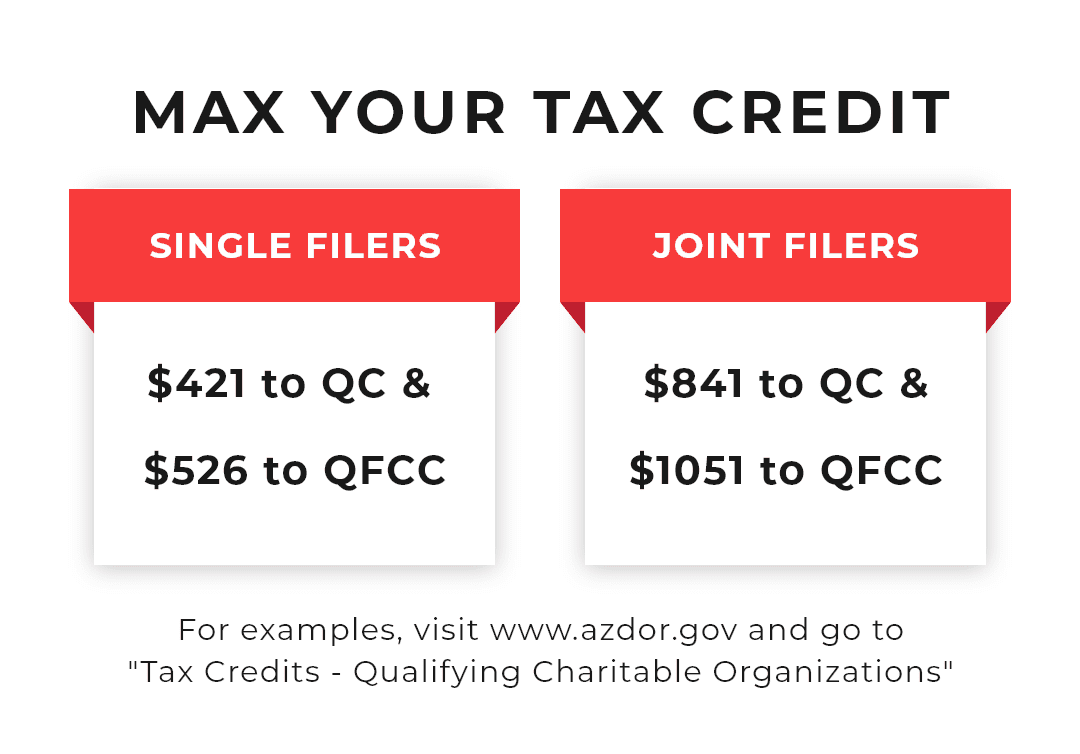

Support Arizona Youth (SAY) is the annual campaign for our organization and Executive Council Charities SAY LLC is an approved umbrella organization for the Arizona Tax Credit for both Qualifying Charities (QC) and Qualifying Foster Care Charities (QFCC). Donors may be eligible for up to an $1,892 tax credit for joint filers and $947 tax credit for single filers and 100% of donations are forwarded on to qualifying charities. You can select “Highest Need” to have the greatest impact or indicate a preference for a specific qualified charity.

TWO GREAT OPPORTUNITIES

QUALIFYING CHARITY TAX CREDIT AND QUALIFYING FOSTER CARE CHARITY TAX CREDIT

DIRECT YOUR TAX DOLLARS

Make a brighter future for nearly 100,000 local youth through SAY!

Arizona tax law allows those who donate through a qualifying umbrella organization like Executive Council Charities SAY, LLC to receive a maximum tax credit of $841 for joint filers and $421 for single filers (or married filing separately) when contributions are directed to Qualifying Charities and an additional maximum tax credit of $1,051 for joint filers and $526 for single filers (or married filing separately) when contributions are directed to Qualifying Foster Care Charities.

Total tax credits (charitable, foster care, school and military) cannot exceed total Arizona tax liability. Neither ECC nor SAY have provided any legal or tax advice. Please consult your personal legal or tax professional or visit www.azdor.gov and scroll to the area for Tax Credits for Qualifying Charitable Organizations. ECC reserves the right to make final SAY designations to qualifying charities.

WHY SUPPORT ARIZONA YOUTH

NEED: Arizona continues to rank among the worst states nationally for child well-being, 39th in the most recent Kids Count Survey by the Annie E. Casey Foundation

EFFICIENT: 100% of your donations to SAY are forwarded to qualifying organizations that serve Arizona’s most disadvantaged youth.

CHOICE: You can select “Highest Need” to have the greatest impact or indicate a preference for a specific qualified charity.

FLEXIBLE: Donation deadline is now extended to Tax Day or continue to make donations before December 31st as most donors still do. You can support both the charitable tax credit and foster care tax credit through SAY.

HOW IT WORKS

Anyone who pays Arizona income tax may be eligible for the tax credit.

You do not have to itemize to qualify.

These tax credits are independent from the Public & Private School Tax Credits – you can take advantage of all of them!

Wouldn’t you rather decide where your tax dollars can make the greatest impact for the kids in our community?

Total tax credits (charitable, foster care, school and military) cannot exceed total Arizona tax liability. Neither ECC nor SAY have provided any legal or tax advice. Please consult your personal legal or tax professional or visit www.azdor.gov and scroll to the area for Tax Credits for Qualifying Charitable Organizations. ECC reserves the right to make final SAY designations to qualifying charities.

IT PRESENTS AN INCREDIBLE OPPORTUNITY TO PROVIDE MAXIMUM SUPPORT FOR LOCAL CHARITIES OFTEN AT NO NET COST!

DONATIONS RECEIVED BY DECEMBER 31, 2023 ARE ELIGIBLE FOR STATE TAX CREDIT FOR 2023. GIFTS CAN BE CASH, CREDIT CARD OR CHECK MADE OUT TO EXECUTIVE COUNCIL CHARITIES SAY LLC.

DONATIONS CAN BE RECEIVED BY APRIL 15, 2024 TO STILL RECEIVE STATE TAX CREDIT FOR 2023.

MAXIMUM LIMITS HAVE GONE UP FOR 2023!